Rent Receipts under IT Scanner: An Analysis of Compliance and Tax Implications

- September 19, 2023

- Latest News

Rent receipts scanned under income tax scanners are subject to tax scrutiny and have received a lot of attention in recent years. Tax authorities have become more cautious in assessing the accuracy and authenticity of taxpayers' rental compensation claims. The purpose of this article is to examine the rent receipts under the IT scanner and the tax consequences of rental revenues.

| Table of Contents: |

Importance of Rent Receipts

Rent receipts under the IT scanner are an important part of income tax filings since they provide evidence for claiming tax benefits such as House Rent Allowance (HRA) and Section 80GG deductions in the Income Tax Act,1961. These receipts serve as proof of expense and must be provided to receive the equivalent tax benefits.

Potential Issues and Challenges

- Fraudulent or Fake Rent Receipts: To exaggerate their rental expenses, taxpayers frequently fabricate or obtain fraudulent rent invoices. Tax authorities are concerned about such actions since they contribute to tax avoidance.

- Unverified Rent Receipts: The inability of tax authorities to cross-verify rent receipts with property owners or landlords creates a loophole in the validation process, potentially resulting in illegitimate tax benefits.

- Rent Receipts for HRA Claims: Employed individuals requesting HRA exemptions must meet the stipulated standards, which include actual rental payments and valid rent receipts.

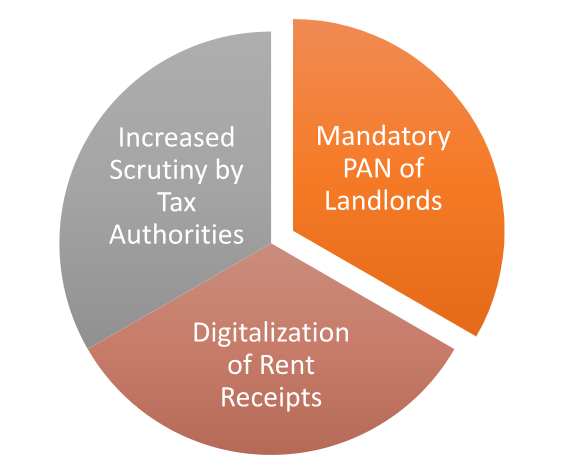

Income Tax Scrutiny and Compliance Measures

- Increased Scrutiny by Tax Authorities: Income tax authorities have increased their efforts in recent years to investigate rent claims through audits and demand extensive evidence. This includes cross-referencing rent revenues with PAN data and undertaking verification site visits.

- Mandatory PAN of Landlords: The government now requires landlords to provide their PAN (Permanent Account Number) when delivering rent receipts. This measure seeks to improve transparency and accountability.

- Digitalization of Rent Receipts: Initiatives such as the digitization of rent receipts have been advocated to allow for smooth validation by tax authorities, limiting the opportunity for fraudulent acts.

Tax Implications and Penalties

- Non-compliance Penalties: Taxpayers who fail to provide actual rent receipts may face penalties and scrutiny, resulting in increased tax liability.

- Tax Evasion and Prosecution: Taxpayers found guilty of tax evasion through the use of forged rent receipts may face legal consequences, including monetary penalties and jail or imprisonment.

- Improving the Rental Ecosystem: Rent receipts are being scrutinized more closely to improve transparency in the rental market, discourage cash-based transactions, and promote a more structured system.

Winding Up Note

The tax authorities' interest in rental revenue demonstrates their commitment to combating tax evasion and ensuring compliance with regulations. Maintaining a fair tax system requires a focus on authentic and valid rent receipts. Taxpayers must understand and comply with the law to avoid penalties and legal consequences.

In case of any query regarding Rent receipts under the Income Tax scanner, feel free to connect with our legal experts at Legal Window at 72407-51000.

Company Secretary and diligent learner deeply immersed in the world of corporate law, compliance, and governance with a focus on developing a robust foundation in legal principles and corporate practices. Passionate about exploring the intricacies of company law, regulatory compliance, and corporate governance.

Categories

- Agreement Drafting (23)

- Annual Compliance (13)

- Change in Business (37)

- Company Law (150)

- Compliance (90)

- Digital Banking (3)

- Drug License (4)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (9)

- FSSAI License/Registration (15)

- GST (124)

- Hallmark Registration (1)

- Income Tax (214)

- Latest News (36)

- Miscellaneous (170)

- NBFC Registration (8)

- NGO (18)

- SEBI Registration (6)

- Section 8 Company (10)

- Start and manage a business (27)

- Startup/ Registration (134)

- Trademark Registration/IPR (48)

Recent Posts

- Major Upgrade: Breaking Down GST 2.0 September 15, 2025

- New Income Tax Bill 2025 August 27, 2025

- ITR-3 Form Explained: Who Should File & Step-by-Step E-Filing Guide (FY 2024-25) June 25, 2025

All Website Tags

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.